Case #9: Due Diligence in 2 hours - How an investor prevented a €5 million bad investment

- Marco Schlimpert

- Nov 29, 2025

- 7 min read

Due Diligence Beyond Excel

A Deep Tech investor faces a classic portfolio decision: 5 promising start-ups, all with groundbreaking technologies. The question is not whether, but which of these companies will achieve Series-A financing first.

Introduction:

This case study shows how a Deep Tech investor conducts due diligence for 5 start-ups in 2 hours using systemic constellation – and identifies an exit candidate that prevented €5 million in wrong investments.

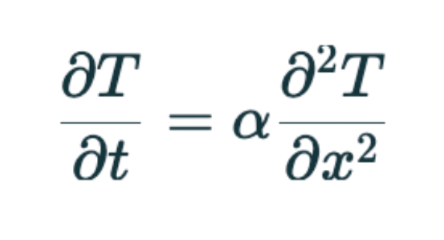

Company Foresight using systemic constellation is a decision visualization tool for complex portfolios and serves as real-time scenario planning. It uses intuitive perception – a method scientifically validated by the Stanford Research Institute in the CIA's Stargate Project. In this specific case, five representatives embody the start-ups and position themselves intuitively in a space divided into four quadrants. Their movements reveal investment priorities that classical due diligence would only show after months.

The following case study demonstrates how it works and what insights emerged.

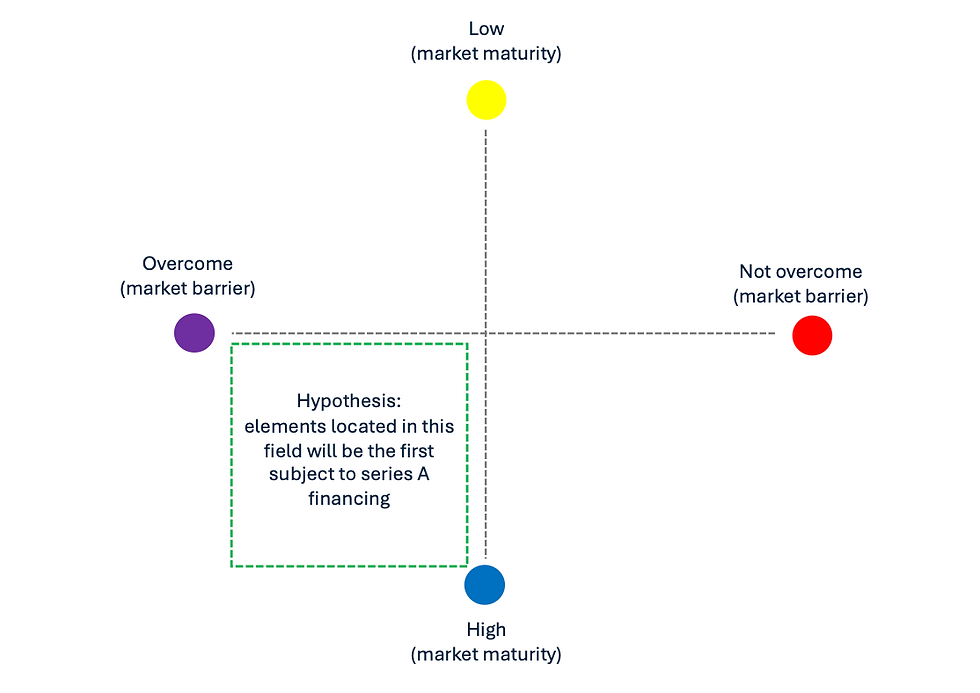

This image forms the basis for Company Foresight:

The starting point: 5 technologies, one breakthrough question

The investor - let's call him Marcus - manages a portfolio in the deep tech sector. His 5 start-ups operate in different fields:

Start-up 1: Energy generation

Start-up 2: Energy conversion

Start-up 3: AI-based time series prediction

Start-up 4: Precision medicine

Start-up 5: Quantum physics

All 5 technologies are unconventional and compete with established approaches. Regulatory barriers and market acceptance are critical factors – even if the technology is feasible.

The breakthrough question: Which start-up will be the first to receive Series A financing?

The method: 4-pole tension field constellation as effective Due diligence tool

Instead of relying solely on traditional financial due diligence, Markus also carried out company foresight - a systemic constellation method that makes strategic decisions visible through intuitive information from the system.

The setup:

A 2x2 matrix with two dimensions:

X-axis: Market maturity (low → high market maturity)

Y-axis: Market entry barriers (overcome → not overcome)

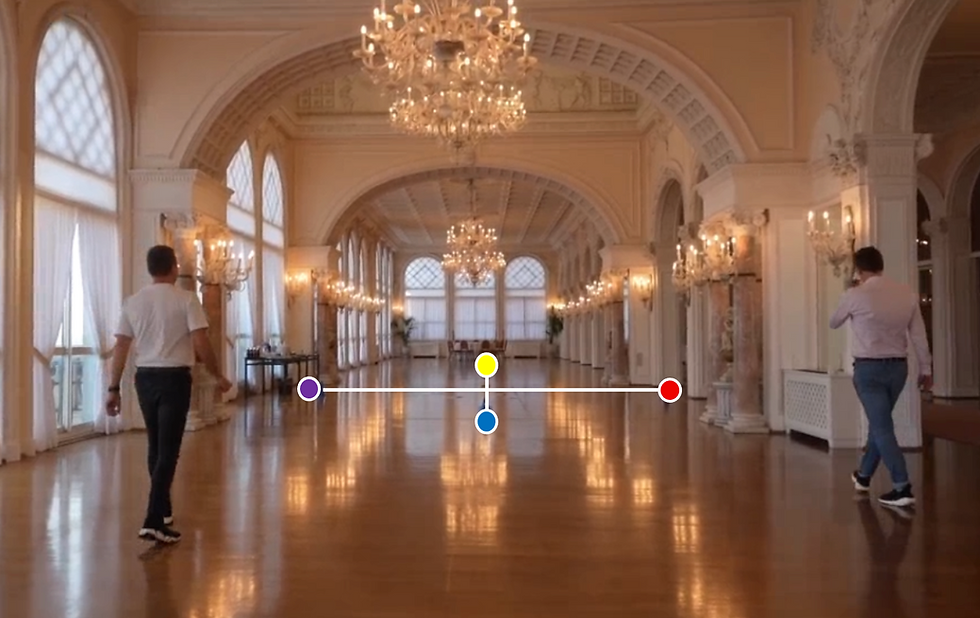

This area of tension is marked on the floor with markings

Five people represent the five start-ups – they represent the respective start-ups.

The procedure:

Concealed procedure: The constellation facilitator numbers the start-ups from 1 to 5. The participants do not know which start-up is coded behind which number. The constellation facilitator now places cards with these numbers on the floor.

Intuitive selection of the number: After a short breathing exercise, the participants spontaneously choose the card whose number appeals to them most. They then intuitively seek out the place in the field of tension that feels best and most “right” to them.

Representative perception: The participants now pay attention to their bodily sensations and associations, as well as their relationships with others in the room.

Questions from the constellation facilitator: The facilitator asks the participants questions in turn, such as:

“How secure are you in your position on a scale of 1-10”

“What do you need to achieve a better scale value?”

“What sensations do you feel?”

“Which element do you have the strongest connection to?”

“What do you need to feel secure?”

Rating system: Each representative answers the questions and rates their “position” on a scale of 1-10, where “1 = poor” and “10 = very good.”

Two interventions with time leaps:

2026: Initial positioning

2028: Time jump – development over two years

Quadrant | Market Maturity | Barriers | Meaning |

Blue / Purple | High | Overcome | SERIES-A READY |

Purple / Yellow | Low | Overcome | Technically ready, market not yet there |

Blue / Red | High | Not overcome | Market wants it, but hurdles are blocking |

Yellow / Red | Low | Not overcome | Early phase, still far from Series-A |

The final picture that emerges for 2026

Following the procedure described above and two rounds of questions, the following picture emerges:

Start-up 1 (energy generation):

Position: moving from low market maturity to high market maturity this year, but has only partially overcome barriers | Rating: 8/10

Start-up 2 (energy conversion):

Position: High market maturity and barriers overcome (optimal quadrant) | Rating: Not assessable.

Special feature: Representative shows extreme exhaustion, collapses to the ground.

Markus confirms: The team has been working for 12 years, one member is almost 80 years old.

Start-up 3 (AI time series):

Position: High market maturity / barriers not overcome | Rating: 7/10

Start-up 4 (precision medicine):

Position: Low market maturity / barriers not overcome (outer corner) | Rating: 10/10

Start-up 5 (quantum physics):

Position: Central at the intersection of all axes | Rating: 10/10

Committed to quadrants, has a need for control in all directions.

Interpretation of the final picture for 2026

Start-up 1 (energy generation) and start-up 3 (AI time series):

Neither has reached market maturity.

Position: High market readiness / barriers not overcome | Rating: 7/10:

Position: Low market readiness / barriers partially overcome | Rating: 8/10

Start-up 2 (energy conversion):

The extreme exhaustion at the optimal position signals that the team has overcome the hurdles and is on the verge of a breakthrough. The 12 years of work are complete. What is missing: regeneration and a new perspective for market entry.

Element 4 (precision medicine):

Occupies a very stable position with low market readiness. It is scientifically valid, but the market is not yet ready. Pushing the market through direct contact with doctors and hospitals would be a waste of resources.

Start-up 5 (quantum physics):

The central position shows a lack of focus. Several use cases exist and are being worked on, but there is no focus through prioritization. This versatility and simultaneity is blocking the breakthrough.

The time leap to the year 2028

The constellation facilitator gives the instruction for the time jump by counting down “3-2-1” and clapping his hands. The representatives reposition themselves, and the constellation facilitator conducts the questioning again.

Start-up 1 (energy production):

Moves to the yellow pole (lowest market maturity) | Rating: 10/10

Paradox: It is undergoing technical improvement while simultaneously declining in market relevance.

Start-up 2 (energy conversion):

Remains in the same position | Rating: 10/10

Stands up, shows full energy and confidence

Start-up 3 (AI time series):

Moves from high to low market readiness, barriers are overcome | Rating: 9/10

Start-up 4 (precision medicine):

Remains unchanged | Rating: 10/10

Start-up 5 (quantum physics):

Moving towards market maturity axis | Rating: 9/10

Interpretation of the final image 2028

Start-up 2 (energy conversion) – From rock bottom to triumph:

Regeneration and a shared vision are crucial. The team overcomes the final hurdle in 2026, but needs time to rest. 2028: The team is ready for launch. The technical barriers have been overcome, the market accepts innovation, and the team is regenerated.

Series A Ready 2028

Start-up 1 (energy generation) – The moving target:

The start-up develops linearly (technical improvement and status at 10/10), but the market develops exponentially in a different direction. Alternative technologies prevail – without element 1. A typical case of “the market has moved on.”

Exit candidate #1. Window: Q4 2025 to Q2 2026

Start-up 3 (AI time series) – Strategic pivot:

The movement is initiated by a successful pivot: the original mass market is too competitive. The pivot to a specialized B2B market reduces the market size but eliminates barriers.

Series A possible in 2029-2030 or exit to fintech platform

Start-up 5 (quantum physics) – Focus brings clarity:

The movement along the market maturity axis towards high market maturity. A primary use case has been selected. Almost Series A ready, the next 3-6 months are critical, adjustments are necessary.

Series A ready at the end of 2028 / beginning of 2029

Start-up 4 (precision medicine) – Patience pays off:

Stability indicates correct positioning. The start-up is not pushing anything; it is waiting for the market to mature.

“Shelf it” – invest minimally, wait until 2030+

Result: Portfolio ranking after 2 hours

🥇 #1 – Start-up 2 (energy conversion) Series A: 2028 ✓ | Strategy: Regeneration 2026–2027, commercial launch 2027–2028

🥈 #2 – Start-up 5 (quantum physics) Series A: end of 2028/2029 ✓ | Strategy: focus on use case, pilot project

🥉 #3 – Start-up 3 (AI time series) Series A: 2029-2030 possible | Strategy: Validate pivot or exit to fintech

⏳ #4 – Start-up 4 (precision medicine) Series A: 2032-2035 | Strategy: “Shelf it” – invest minimally, wait

❌ #5 – Start-up 1 (energy generation) Series A: <1% | Strategy: Immediate exit Q4 2025 – Q2 2026

The surprise: there is a tandem dynamic

Start-up 2 and Start-up 5 are systemically linked. Both operate in the field of fundamental physics, both seem “too good to be true,” and both fought skepticism for years.

The strategic consequence: the success of Start-up 2 opens the door for Start-up 5:

Market psychology: “Proof of concept” builds trust among investors.

Investor synergy: Lead investor interested in both.

Common narrative: “Deep Physics Revolution.”

This leads to the investment strategy: Treat as a tandem – coordinated financing (2028/2029, same lead), cross-learning, joint updates.

Learning: Why is Company Foresight so valuable for investment, portfolio, and M&A decisions?

Company Foresight complements quantitative due diligence with four crucial dimensions:

First, it creates enormous time efficiency: While classic due diligence requires 2-4 months per start-up, Company Foresight delivers clear insights for all five start-ups simultaneously in just 2 hours.

Second, the method reveals invisible dynamics that remain hidden in Excel sheets. While traditional analyses show numbers, metrics, and burn rate, Company Foresight reveals team dynamics, systemic blockages, and critical timing. In Element 2, for example, traditional metrics would have signaled “team burned out” and led to a “do not invest” conclusion. However, the systemic interpretation shows that the exhaustion came after the breakthrough – exactly the right time to invest.

Third, Company Foresight enables relative evaluation instead of isolated individual analyses. Instead of making five separate “yes/no” decisions, a coherent portfolio strategy emerges with clear priorities and optimal timing.

Fourth, the method minimizes risks through early detection. Without Company Foresight, Markus would have invested another 2-3 years in Element 1 and burned through €5 million. With Company Foresight, it became clear after two hours: exit now, not later.

Business Intelligence beyond Algorithms

What if you could make informed complex portfolio decisions after two hours instead of months of analysis? What if you could see the systemic dynamics that determine success or failure?

Company Foresight makes this possible. Systematized intuition—trained perception of emerging information.

The question is not whether systemic constellations work. The question is: Can you afford not to use them?

Your next step

You now have an insight into how Company Foresight works—and why it is an ideal complement to traditional due diligence.

👉 Take a look at my website www.marcoschlimpert.com/en

Arrange a no-obligation consultation with me or ask my personal AI assistant, who will answer your questions.

30 minutes is usually enough to clarify whether and how Company Foresight can help in your specific case.

Comments